The IPO for Mukka Proteins, which raised ₹67.20 crore from anchor investors, began on February 29 and ends on March 4. With a lot size of 535 shares, the IPO price range is ₹26 to ₹28 per equity share.Subscription status for Mukka Proteins IPO: Investor interest for Mukka Proteins IPO remained extremely strong on day three.

According to BSE data, the IPO subscription status for Mukka Proteins is 136.99 times.

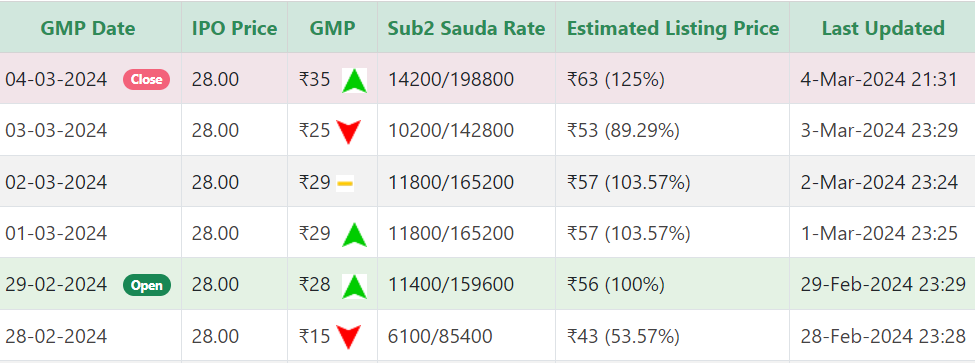

Mukka Proteins Day-wise IPO GMP Trend

Day 3 saw 58.52 subscriptions for the retail investors portion of Mukka Proteins’ initial public offering (IPO), 250.38 bookings for the non-institutional investors (NII) portion, and 189.28 bookings for the qualified institutional buyers (QIB) portion.

Even on day two, investor reaction to Mukka Proteins’ initial public offering (IPO) was largely positive. According to BSE data, Mukka Proteins’ IPO subscription status was 6.97 times.

Day 2 has seen 10.21 bookings for the regular investors’ portion, 6.22 subscriptions for the Non Institutional Investors’ (NII) portion, and 1.86 subscriptions for the Qualified Institutional Buyers’ (QIB) portion.

Mukka Proteins IPO got off to a strong start on its first day of operation, with its retail part being fully subscribed within the first two hours of opening. According to BSE data, the IPO subscription rate for Mukka Proteins was 2.47 times on Day 1.

Day 1 of the Mukka Proteins IPO saw 3.70 subscriptions from retail investors, 1.55 bookings from non-institutional investors, and 1.01 bookings from qualified institutional buyers.

IPO Starting Began from

The IPO for Mukka Proteins began on February 29 and ends on March 4. Anchor investors contributed ₹67.20 crore to the fund.It has set aside a minimum of 15% of the shares for NIIs, a maximum of 50% of the shares for QIBs, and a minimum of 35% of the offer for retail investors in the public offering.

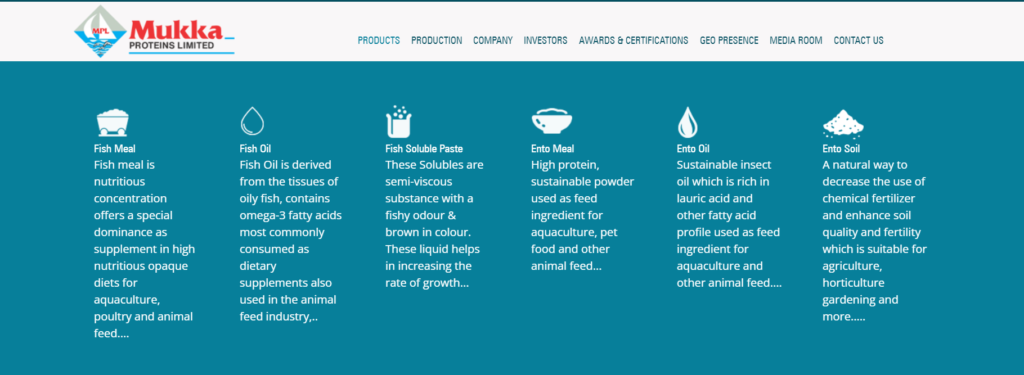

Fish meal, fish oil, and fish soluble paste are produced and sold by Mukka Proteins Ltd. These products are essential to the creation of aqua feed (for fish and prawns), chicken feed (for grilling and layering), and pet food (chow for dogs and cats).

The price range for Mukka Proteins’ initial public offering (IPO) is ₹26 to ₹28 per equity share with a face value of Re 1. Size of Mukka Proteins’ IPO lot

Mukka Proteins IPO subscription status

According to BSE data, bids have been received for 7,67,16,38,920 shares of the 5,60,00,435 shares that were offered in the Mukka Proteins IPO.

1-Out of the 2,80,000 shares that were offered for this segment, bids for 1,63,84,93,140 shares were received by the retail investors’ component.

2-Out of the 1,20,000 shares that were offered for this segment, bids for 3,00,46,14,570 shares were received by the non-institutional investors component.

3-Out of the 1,60,00,435 shares that were offered for this segment, bids for 3,02,85,31,210 shares were received for the QIB part.

Mukka Proteins IPO details

The ₹224 crore Mukka Proteins IPO consists of a new issuance of 8,00,00,000 equity shares with a face value of Re 1. There isn’t a component that is for sale.

According to the red herring prospectus (RHP), the company plans to fund its working capital needs as well as general corporate objectives and an investment in Ento Proteins Private Limited, an associate. The net proceeds from the issuance will be used for these reasons.

Fedex Securities Pvt Ltd is the book running lead manager for the Mukka Proteins IPO, while Cameo Corporate Services Limited is the registrar.

Mukka Proteins IPO GMP today

The IPO GMP or gray market premium for Mukka Proteins is +35. This suggests that, according to investorgain.com, the share price of Mukka Proteins was selling at a premium of ₹35 on the black market.

Based on the upper end of the IPO pricing range and the existing premium on the grey market, Mukka Proteins’ expected listing price is ₹63 per share, which is 125% more than the IPO price of ₹28.

The IPO GMP anticipates a robust listing based on the actions of the gray market over the last 28 sessions. Analysts at investorgain.com estimate that the lowest GMP is ₹0 and the highest GMP is ₹35.

A “grey market premium” denotes the willingness of investors to part with more money than the issue price.

Also read: Tata Electric IPO: The Tata Group is preparing to launch another IPO for raising $1–$2 billion.